Once the excitement of your engagement wears off, the reality of wedding planning usually starts to set in. There are a million and one decision to make on everything from the venue, photographer, food, beverage, to music and transportation. And that’s just the tip of the iceberg.

Of course, every bride manages to bring it all together before the big day and you will too, especially if you have a good handle on your finances.

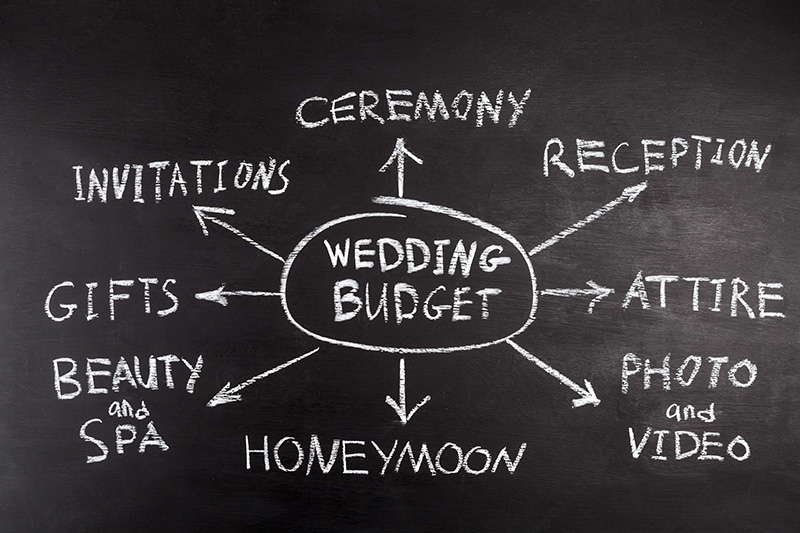

Sticking to your budget is the most important thing you can do to properly prepare for your wedding day. By going over budget, you run the risk of going into debt, even before you’ve said: “I do.” But with the cost of the average wedding in the United States hovering over $35,000, it’s more important than ever to have both a financial plan and budget.

So, how are you going to pay for your nuptials? Here are a few ways to manage the cost of your wedding day.

Paying as You Go

The easiest way to cover your wedding expenses is to pay as you go. Most vendors require either upfront costs when you sign the contract or a deposit with the fees paid in full at the time of the event.

By paying as you go, you’ll be able to follow your budget precisely and document each expense as it arises.

Helpful Hint: Start a separate checking or savings account to handle only the wedding expenses.

Taking Out a Loan

If you simply don’t have the upfront cash to handle the cost of your dream wedding, consider taking out a loan. While this may not be the best option for some couples, there are brides and grooms that benefit from having the extra loan money on-hand throughout the planning process.

When it comes to loans, you have two main options:

Personal Loan

A personal loan is available to most good credit-holders. The interest rates on personal loans are higher than other forms of loans, but the money comes available immediately and is paid off over a particular time period.

Home Equity Loan

Homeowners with equity may want to consider a home equity loan, which takes into account the market value of your home against what you owe on it. For example, if you own a home work $200,000 and you have a $100,000 loan, you may be able to borrow up to 80% of the home’s value minus your original loan amount. In this case, you may qualify for a loan up to $60,000. Keep in mind that you may need to pay additional fees for a home appraisal and origination costs. In general, home equity loan interest rates are lower than personal loans.

Negotiating Fees

Another way to pay for your wedding day is to negotiate, within reason, with your vendors. In some cases, you may have vendors that are willing to knock off 10-20% just by paying up front.

Recruiting Friends/Family

Some of your friends have skills that may help keep your overall spending down. Whether you have a friend or family member who’s a great baker or know a band willing to play music for free or at a nominal rate, if you’re comfortable doing so, don’t hesitate to see if they’re interested in helping you out.

Helpful hint: While it’s okay to ask a friend to create your wedding cake or help you with your invites, keep in mind that there are some services best left to professionals, including photography and food/beverage.

Asking for Help

In some social and family circles, it’s acceptable to ask family and friends to help offset the cost of the wedding. Of course, this isn’t always the best case scenario, so be careful not to offend or assume people are interested in helping you pay for your wedding day.

If your parents or other similar relation has paid for a sibling’s wedding in the past, then they may be willing to pay a portion of your wedding as well. It doesn’t hurt to ask for help, just be mindful that this request may come with stipulations or possibly even a “no.”

Paying for a wedding is one of the biggest hurdles a bride and groom must overcome leading up to their wedding day.

Do you have experience paying for a wedding? Let us know how you handled it in the comments below!